Sacco Software / Sacco ERP /Credit Co-operative Software

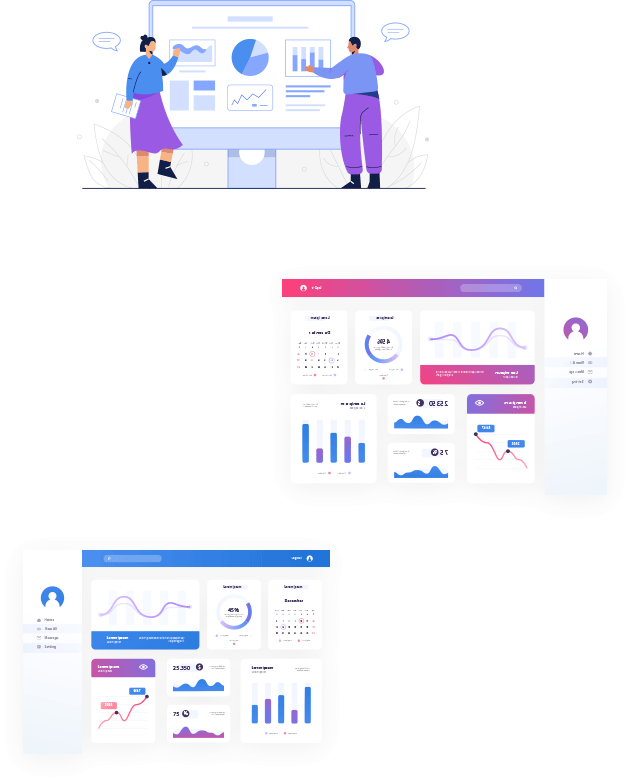

Our SACCO360 Web Express is a comprehensive web-based and mobile solution designed for efficient Sacco/credit management

across multi-branches or regions, whether on the cloud or on-premises. Tailor-made for startups, small, medium, and large SACCOs,

it supports both BOSA (back office) and FOSA (front and back office).

The platform runs on Web, USSD, and Android apps, fully integrated with core banking, offering scalability, reliability,

and ease of use. Customized for global markets, including Kenya, Tanzania, Uganda, Rwanda, and beyond, it delivers 12+ years

of expertise in savings and credit organization software.