MICROFINANCE SOFTWARE

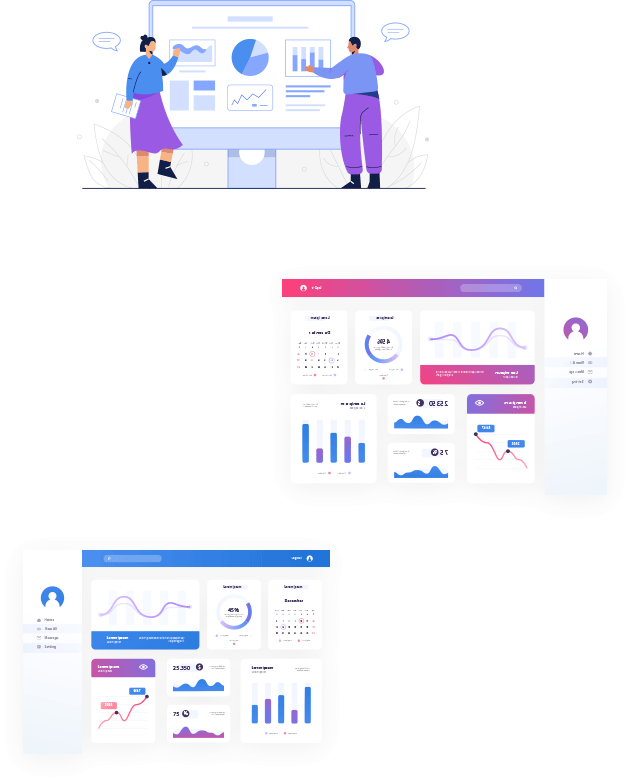

MFI360 Web Express is a Microfinance solution designed on a web-based platform and mobile technology that is easy to learn and use in managing microfinance operations. The solution offers our clients scalability and implementation reprieve, especially in the management of several multi-braches or regions over the “cloud”. MFI360 is tailor-made for small and large microfinance(s) which are either deposit-taking or not. The software has other channels such as USSD, Mobile App that supports your business. It comes with a versatile structure that allows scalability to the highest level. It's customized for ALL MICRO FINANCES/Credit Organizations around the world i.e Africa Market; E.g. Kenya, Tanzania, Uganda, Rwanda and Burundi, Malawi, Somalia, South Sudan, Ghana, Ethiopia, Botswana; Europe, America , Asia and other markets that practice saving, and credit/lending organizations, etc